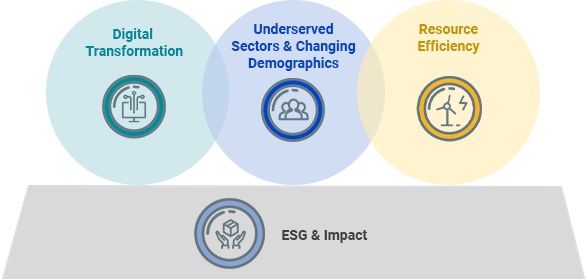

Investment Themes

We set out to invest in companies that address one or more of the following market trends, in all cases underpinned by a robust ESG & impact strategy as a key value driver and risk mitigator

- Companies that provide a key digital service or technology to consumers or businesses in Latin America to help accelerate their transition to an increasingly digital economy

- Includes both digital-native and traditional businesses that can be transformed through the introduction of new technologies, taking advantage of our experience in various technology verticals

- We believe Latin America is experiencing massive change in this area led by companies in the FinTech, Software as a Service (SaaS), EdTech and Telecom/Fiber Optic sectors, among others

- Acceleration in the pace of digital transformation has been an unexpected positive outcome of the pandemic

Operating Partners:

Portfolio Examples:

ESG & Impact

ESG & Impact

- Linzor seeks to bring access to the global digital economy to Latin American consumers and businesses, driving economic and human development across the region

- We believe in implementing best practices in data protection, governance, employment, gender diversity, energy efficiency, among others

Sample SDGs addressed:

- Companies that meet social demands for important services, such as healthcare, education and financial services, with a dual focus on affordability and quality

- We believe there is a deficit in many of these services, in which incumbents do not reach the entire population or do not offer an attractive value proposition

- In our view, these services are demanded by large segments of the population, many of whom rose to the middle class over the past two decades

- We partner with management teams that are aligned with the goal of creating long-term value for all stakeholders

Operating Partners:

- Álvaro Puerto

- Ricardo Duch

- Ricardo Phillips

- Ernesto Moya

- Juan Pablo Loperena

Portfolio Examples:

ESG & Impact

ESG & Impact

- Linzor seeks to generate long-lasting positive social impact by bringing high quality services to previously unattended populations

- We aim to leverage the vast community of clients, employees and suppliers to generate awareness and promote progress towards greater diversity, equality & inclusion and sustainability

- We believe in implementing best practices in community engagement, governance, employment, gender diversity, energy efficiency, among others

Sample SDGs addressed:

- Companies that offer a solution or otherwise contribute to a more sustainable and healthy use and consumption of the region’s resources

- We believe these companies will acquire increased relevance as the adoption of net zero/carbon neutral commitments and social responsibility objectives by companies and governments accelerates

- Our thesis is that companies offering sustainable or eco-friendly alternatives to traditional products and services will capture increased demand from a shift in consumer preferences

Advisors:

High Priority Opportunities:

- Waste management

- Renewable energy

- Nutrition and wellness

- Water treatment

- Sustainable and healthy foods

- Recycling of materials

- Food waste management

- Carbon capture and utilization

- Green mobility

ESG & Impact

ESG & Impact

- Linzor seeks to drive progress towards climate goals, conservation of biodiversity, and responsible use of scarce resources

- Linzor will seek companies that offer solutions to mitigate the impact of climate change

- We believe in implementing best practices in climate action, sustainable processes, governance, employment, gender diversity, energy efficiency, among others

Sample SDGs addressed: